Advice from a Financial Advisor

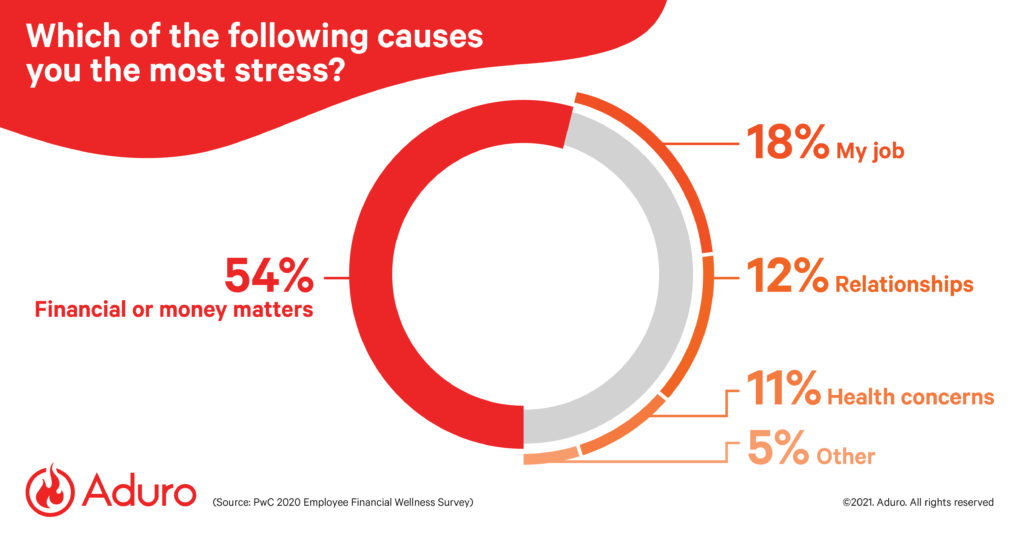

In a recent survey by PwC, employees answered the question, “Which of the following causes you the most stress?” 54% stated financial or money matters and the primary cause of stress in their lives.

Beyond the critical financial decisions needed to get through the immediate impact of COVID-19, employees will need guidance as they recover financially and strive to protect themselves from future economic issues.

Last month we connected with Adam Costarella from Calibri Capital as part of Ameriprise Financial. In the webinar, we learned that a holistic well-being program is the first step employers can take to best support their employees.

Holistic financial well-being

It’s important to understand that employers and employees view financial wellness in different ways.

From the employee perspective: Financial wellness includes freedom from financial stressors such as worry about unexpected expenses and debt.

From the employer perspective: Financial wellness is centered around the state of a person fully able to meet their ongoing financial obligations and securing their financial future.

The problem with these two perspectives is that one is focused on today’s stressors, and the other is focused on supporting the future.

Outside of the primary check-the-box benefit of a 401K, Costarella advises employers to offer a Holistic Financial Wellness Program as a relief from the financial stress of today and tomorrow. The all-encompassing program provides employees an understanding of their overall financial situation, tools, and resources to adapt to their financial situation. This results in their feeling more prepared for future economic challenges.

The employee financial program must cover all aspects of their financial life: debt, income, level of insurance, and even risk management. It’s a deeper look beyond a 401K to make sure they are financially healthy.

What is the impact of financial stress on an organization?

In considering financial stressors, there are several ways the organization can be impacted.

- Productivity: 46% of employees feel distracted by their finances while at work—resulting in 78,000 hours of lost productivity per year for every 1,000 employees. (PwC)

- Absenteeism: Financial stress results in a 34% increase in absenteeism and tardiness. (SHRM)

- Presenteeism: Coming to work sick (physically or mentally) to prevent missed pay – ultimately costs the company significantly in presenteeism. Financially healthy employees may be less distracted by money problems and better able to focus on their jobs. (SHRM)

- Loyalty and Retention: According to MetLife’s Annual U.S. Employee Benefits Trends Study, 72% of employers agree that customizing benefits increases loyalty in the company. A culture of holistic support goes a long way. (MetLife)

- Improved Mental and Physical Health: Financial well-being is directly related to mental and physical health. Many people lose sleep over financial stress and may have symptoms of anxiety, headaches, weakened immune systems, and chronic health concerns. Financial piece-of-mind can dramatically decrease these symptoms. (Purdue)

Get started in supporting employee financial well-being

62% of employers feel “extremely” responsible for employee financial wellness, but what resources and programs can they offer that make an impact?

Communication – Financial wellness education is essential for organization to help inform employees and drive engagement in the benefits offered. This education can’t be a one-and-done event.

- Time – Devote more than 30 minutes in an open enrollment meeting to help employees understand what is available to them.

- Availability – Be available to help employees gain a better understanding to get the most out of their benefits.

- Year-long Strategy – Build financial resources into your year-long communication strategy and make this important topic part of the conversation, reducing the stigma associated with talking about finances.

Well-being Program – A holistic employee well-being program offers resources and tools that support every aspect of a person’s life, including financial support. Highlighting economic benefits inside of your program and be another avenue for communicating to employees.

Aduro’s Coaches and interactive content are also special tools for helping individuals get started in a journey to financial freedom. Our one-on-one coaches can provide a safe, judgment-free space for individuals to overcome barriers they may have. On-demand programming can offer support in topics such as creating a budget, reducing daily spending, and setting financial goals.

Expanded Benefits – Go beyond the 401K with a holistic well-being program. Consider offering additional financial benefits to your employees, such as dedicated financial planners to help employees understand actions they can take today to support their goals. Offering tuition reimbursement and student loan support is also an excellent way to lighten your employees’ financial stressors.

Don’t Wait – Get Started Today!

Most people with financial stress don’t know where to start, and it’s important to remember each person’s journey is personal and unique. Financial education is an important part of the process, but bringing awareness to the habits, mindset, and behaviors we have around money is the first step to making impactful positive change.

To gain even more guidance from our financial experts, enroll in our 6 Aspects of Life video series to watch our Money & Prosperity session.